9 Reasons Businesses Choose Jain Software for IPR Services

In Official Blog, Business, Digital Marketing, Entrance Corner, Entrepreneurship, GAMES, government, Graphic Design, Services on Perfection

IPR

The importance of safeguarding IPRs can be particularly understood in the contemporary business environment where many organizations need to distinguish themselves to create value and achieve growth trajectories. Jain Software an IT solution provider company holds its reputation and offers specialized service in IPR (Intellectual Property Rights). These trademark services include registering trademarks and copyrights and handling patents; Jain Software assists companies in protecting their creations.

Here are nine compelling reasons why businesses choose Jain Software for IPR services:

1. Having rich experience in Complete IPR Services

Jain Software provides all types of IPR services to the clients depending on their needs of the business. These include:

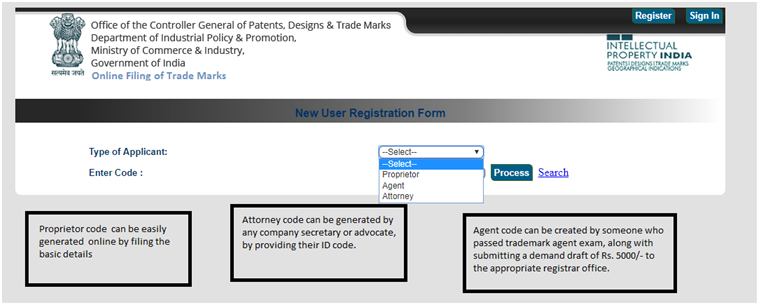

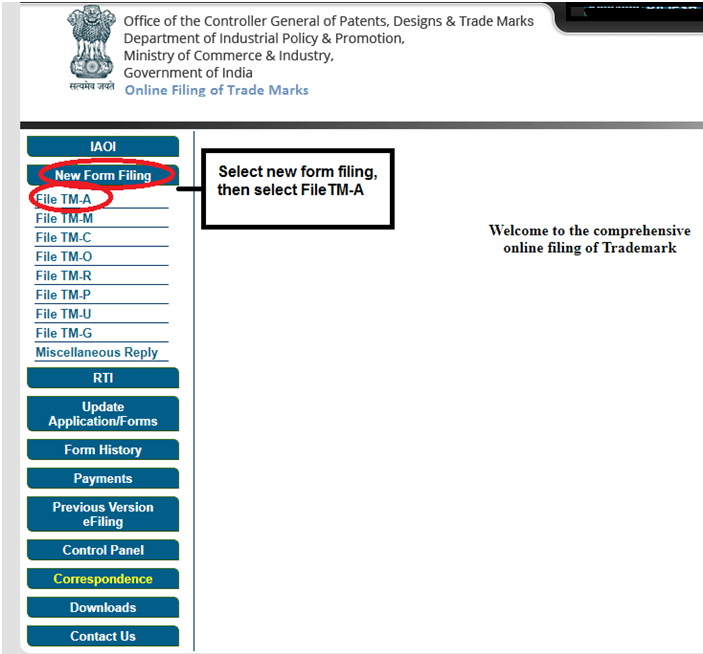

- Trademark protection and registration

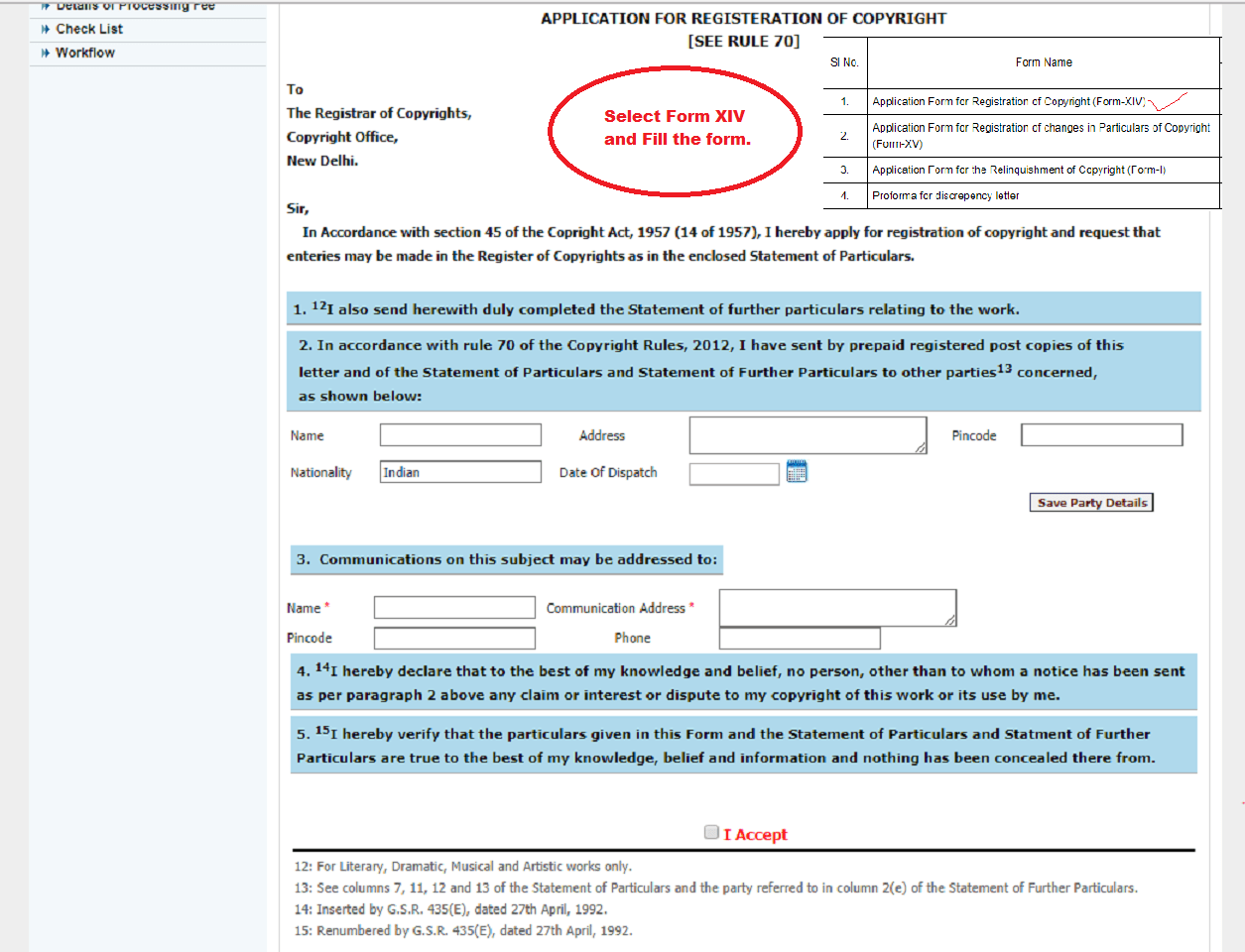

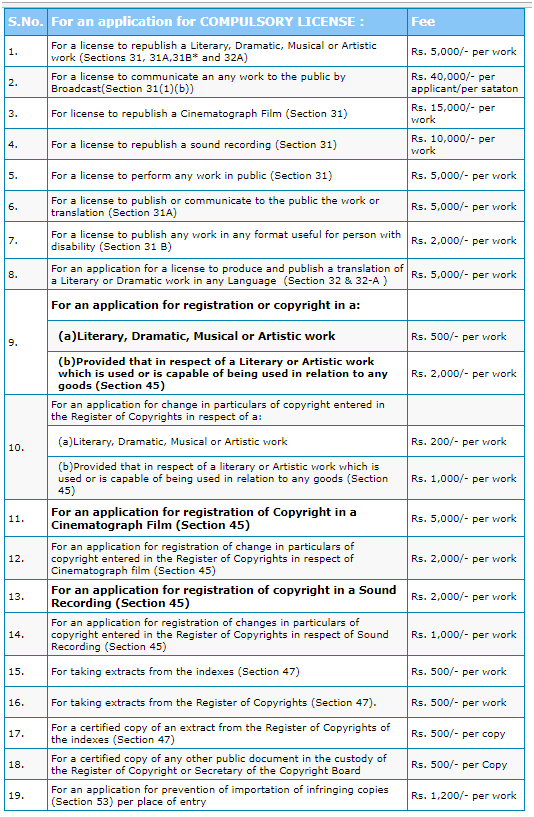

- Copyright registration

- Patent filing and management

- Design registration

- IPR infringement protection

Due to their vast experience of the nuances of the intellectual property law, they guarantee that all aspects of your companies creations, innovations and brands are legally protected. With Jain Software’s systematic strategy, whether for product introduction, or internationalization, you reduce the risk while leveraging your valuable IP.

2. Specialized Services for Varying Industries

Jain Software realizes that every industry has specific issues with confidence, which are intellectual property. Their team customizes solutions to align with the specific requirements of industries such as:

- Healthcare: To guarantee that new medical innovations are protected and that trademark rights are granted to hospitals.

- E-commerce: Protecting a product’s brand name and proprietary technologies.

- Education: Securing the learning contents and the software applications.

- Manufacturing: Obtaining patents for products and creations or ideas to make and produce.

Such specialization in the context of industry makes Jain Software one of the most sought after solution providers for different types of business.

3. End-to-End IPR Management

Unlike firms that focus solely on filing IPR applications, Jain Software offers end-to-end services, including:

- Comprehensive scans of intellectual property rights.

- The other activity is identifying conflicts; it involves conducting prior study in existing IP databases.

- Presentation of applications to the concerned Department or ministry.

- Trademark, copyright, and patent observation and update.

- Disputes and litigation Management.

In addition to ensuring clients obtain rights, Jain Software offers services in all the stages of the IPR lifecycle to ensure clients manage and enforce the rights appropriately.

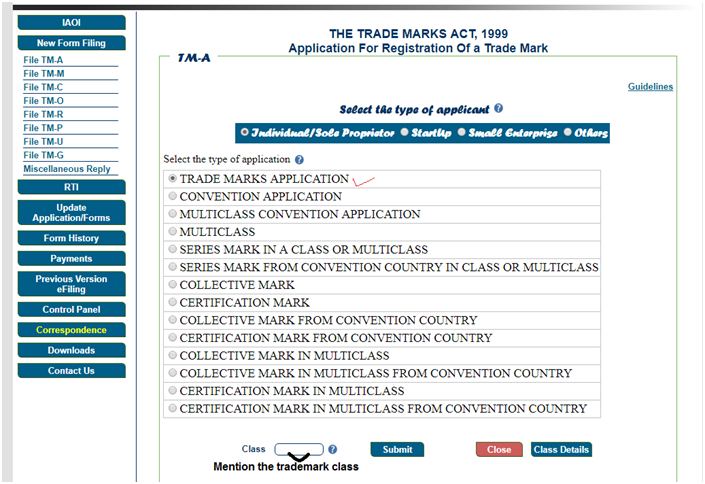

4. Trademark Services is specialized.

Trademarks are essential elements in building brand image. At Jain Software, we pride ourselves with ability to register most appropriate trademarks that accord with your organization’s goals and objectives. Their services include:

- People search for comprehensive searches in check for the distinctiveness of the brand name or logo.

- Filing trademarks applications with accuracy to prevent elimination of the marks.

- Services aimed at renewal of trademarks that must be provided to keep them active.

- The prevention of trademarks from being violated by the law.

Jain Software maintains your brand identity unique and legally protected while serving as your partner for change.

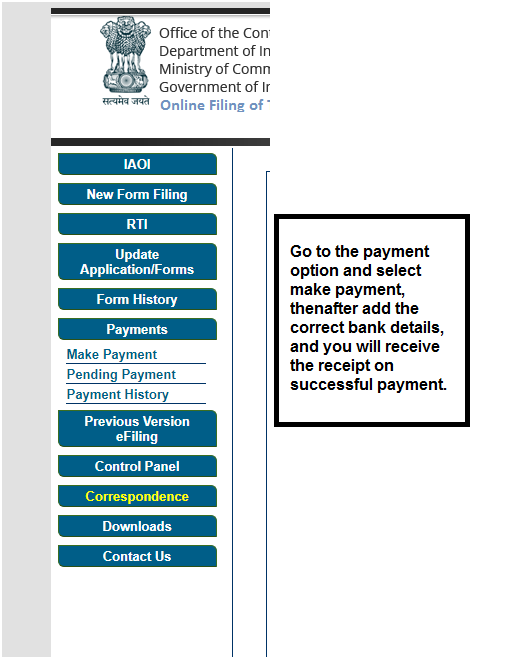

5. Pricing also remain reasonable and more importantly we offer it at an educated price.

As a form of legal regulation, protection of intellectual property is regarded as an expensive and rather cumbersome procedure. Jain Software breaks this stereotype by offering:

- Always being able to offer competitive prices for all its IPR services.

- They include clear visibility with charges regarding advanced connectivity brokers and no hidden costs.

- Affordable packages to fit startups, small companies and big enterprises.

Their dedication to keeping the costs down guarantees that organizations both large and small can obtain the best IPR services available without worrying about finance.

IPR

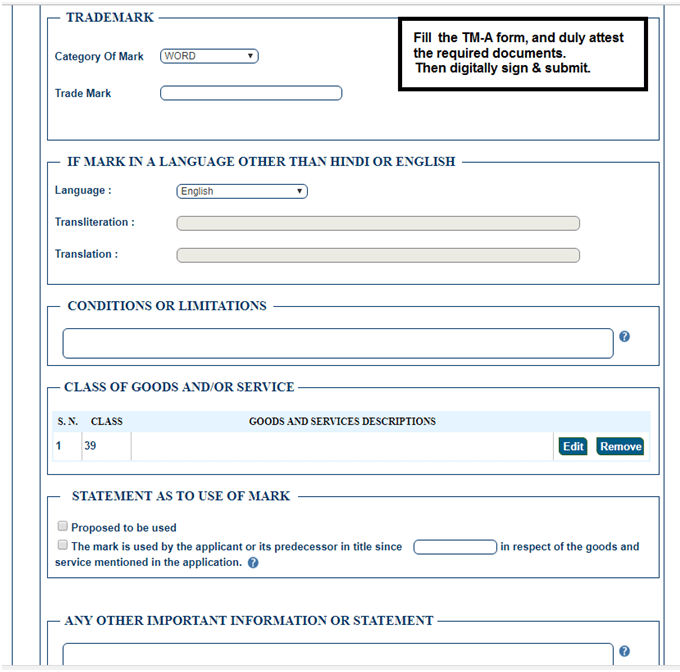

6. Technical IPR Procedures

As IT solution provider, Jain Software has been able to employ use of technology to ease IPR procedures. Their technology-driven approach includes:

- In the present time, more superior techniques for trademark and patent searches are available.

- Application of filing systems in digital form to avoid mistakes when applying.

- Alerts for renewal of the plans so that protection is not a weaken at any point of time.

This also has the added advantage of permitting efficient processing, accuracy and compliance to set regulations.

7. Marketing Experience that has delivered Real Results

Jain Software’s basket of successful IPR projects indicate volumes about their credibility. Businesses have consistently achieved:

- The time taken to approve registration.

- Higher chances of receiving stronger protection against infringement.

- Some have been court cases where our legal department at Jain Software has help secure a favorable outcome.

Their experience puts them in a vantage position and businesses looking for credible IPR services seek out this team.

8. There is a dedicated Legal and Technical Team

As part of our IPR team, Jain Software has the legal and paralegal talent coupled with technical specialists. This dual expertise ensures that:

- The tenets of intellectual property laws are well understood and followed with a lot of care.

- In patenting processes, therefore, there are clear records on aspects such as specifications.

- For their IPR needs, clients are given a comprehensive service with support from different personnel.

This comprehensive paper guarantee that each IPR application complies with both legal requirements and technical specifications leading to its approval.

https://www.jain.software/6-it-challenges-solved-by-jain-software-team

9. Commitment to Client Success

In Jain Software there is nothing more important than the successful outcome that the client desires. They took an individual perspective ensuring companies receive utmost support during the IPR process. They offer:

- Private meetings with the client to identify his/her requirements.

- Application updates are also The other critical features that can be incorporated on the mobile application include:

- Preventive measures that maybe useful in eradicating or preventing potential risks to the company’s IP.

Their business model of creating LONG TERM relationships convinces clients not just to view Jain Software as a vendor but as part of their growth strategy.

Case Studies: Testimonials with Jain Software

To illustrate the impact of Jain Software’s IPR services, here are a few success stories:

Case 1: A Startup’s Trademark Victory

A young e-business firm contacted Jain Software for registering its brand name. Jain Software used research that was conducted to help determine if there was likely to be any conflicts and ensured that they filed an application that could not be challenged. It is when a competitor filed opposition to the trademark belonging to Jain Software; the client’s legal department prevailed and safeguarded the company’s brand.

Case 2: Protection of a Patent for an Inventor

A OHM in the health system partnered with Jain Software to apply for a patent in a novel pressure sensor medical equipment. Raju and Jain Software’s technical professionals delicately recorded the invention details thereby following the legal aspects required for patents by the legal department of the organisation. This led to a quick approval and a strong preservation against copying.

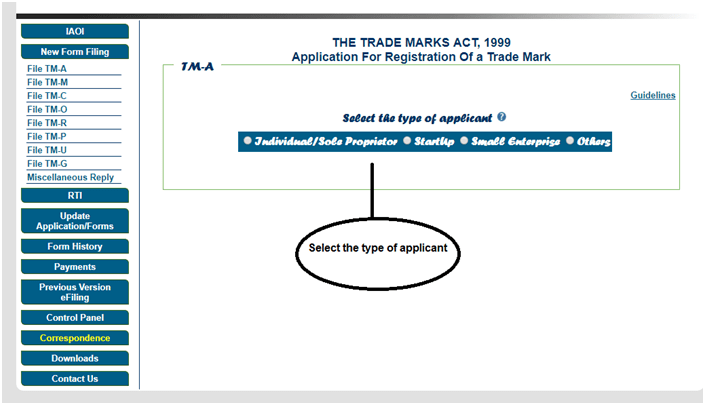

How to Start: Jain software for IPR Services

Partnering with Jain Software for IPR protection is simple:

- Consultation: Booking a meeting to help you with your intellectual property requirements.

- Planning: Get a specific and unique solution to your IPR problem by applying for IPR services.

- Implementation: Let Jain Software deal with filing, tracking, and overseeing your IP portfolio.

Conclusion

As we are aware that the World today is characterized by owning brands and a business’ USP is its intellectual property, Jain Software emerges a winner in IPR services. By using their experience, innovation, and professionalism together with their obsession with the satisfaction of the customers, they guarantee that your ideas, inventions and trademarks are protected.

Patent protection or a trademark for your logo – no challenge is too small or too large for Jain Software; whether you are a start-up business or an already growing company. Select Jain Software to protect your idea and provide your business with long-term development opportunities.

It ensures you protect what is yours – join Jain Software today!

Follow Social Media :

https://www.facebook.com/jainsoftware/

https://www.instagram.com/jainsoftware/

https://www.linkedin.com/company/jainsoftware

https://x.com/jainsoftware