E-filing of Copyright in India:

In government, Indian Economy, Official Blog, Services on PerfectionA copyright is essentially a right not to copy someone’s work. A copyright gives the owner of the subject an exclusive right over his work. If a work is protected by copyright, no one can imitate, copy or reproduce the original work in any other way.

The register of the Registrar of Copyrights is divided into 6 categories:

PART – 1: Literary works other than computer Programs

PART – 2: Musical Works

PART – 3: Artistic Works

PART – 4: Cinematography Films

PART – 5: Sound Recording

PART – 6:  Computer Programs, tables & Compilations

Copyright can be taken for the following works:

- Music

- Books

- Manuscripts

- Films

- Fashion Designs

- Training Manuals

- Software

- Literary Work

- Paintings etc.

Documents required:

A copy of the work needs to be provided along with the address and identity proof of the owner is required. For a company, the name of the company along with its Certificate of Incorporation and Address proof is required.

Details required for Copyright Registration:

Personal details: This includes the name, address and nationality of applicant. Applicant should specify the nature. Whether he is the owner or the representative.

Nature of the work: This includes class and description of the work, title of the work. In case of a website copyright, give the URL of the website. You also need to mention the language of the work.

Date of publication: Mention the date of publication in internal magazines (if possible). Like a company magazine or a research paper submitted to a professor does not count as publication.

Copyright Registration:

The Copyright Act, 1957 helps you in protecting the original or genuine literature, drama, music and artistic work. And ideas, procedures or even the methods of operation can never be copyrighted. In a layman’s language, a copyright is an exclusive right granted to the owner in order to protect his work from being copied, exploited or misused.

Doing a particular work takes lots of efforts and energy and therefore protecting the work done is as important as doing a work. Hence, one of the mediums through which one can protect as well as enjoy certain rights over his/ her works is Copyright.

The only owner of registered work can use the product or even can grant permission to another person.

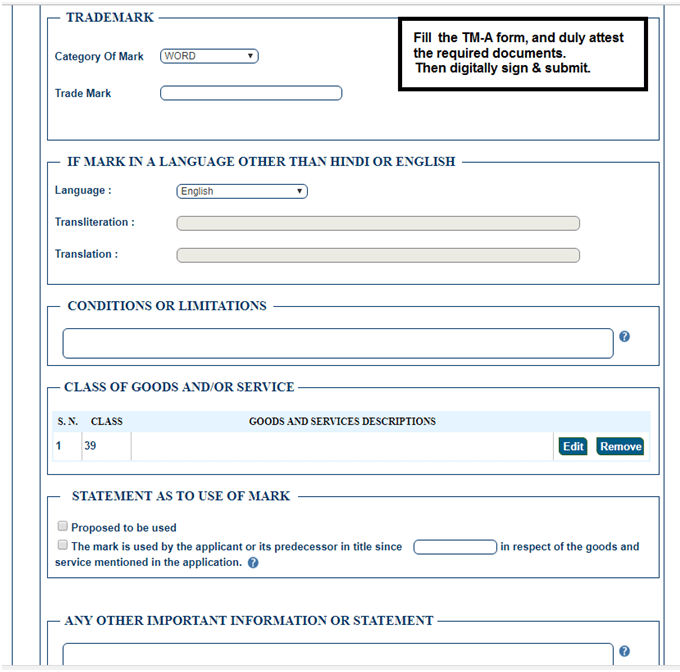

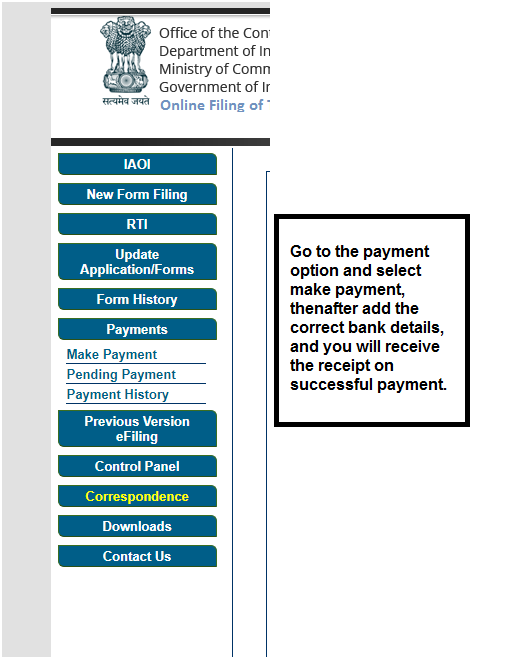

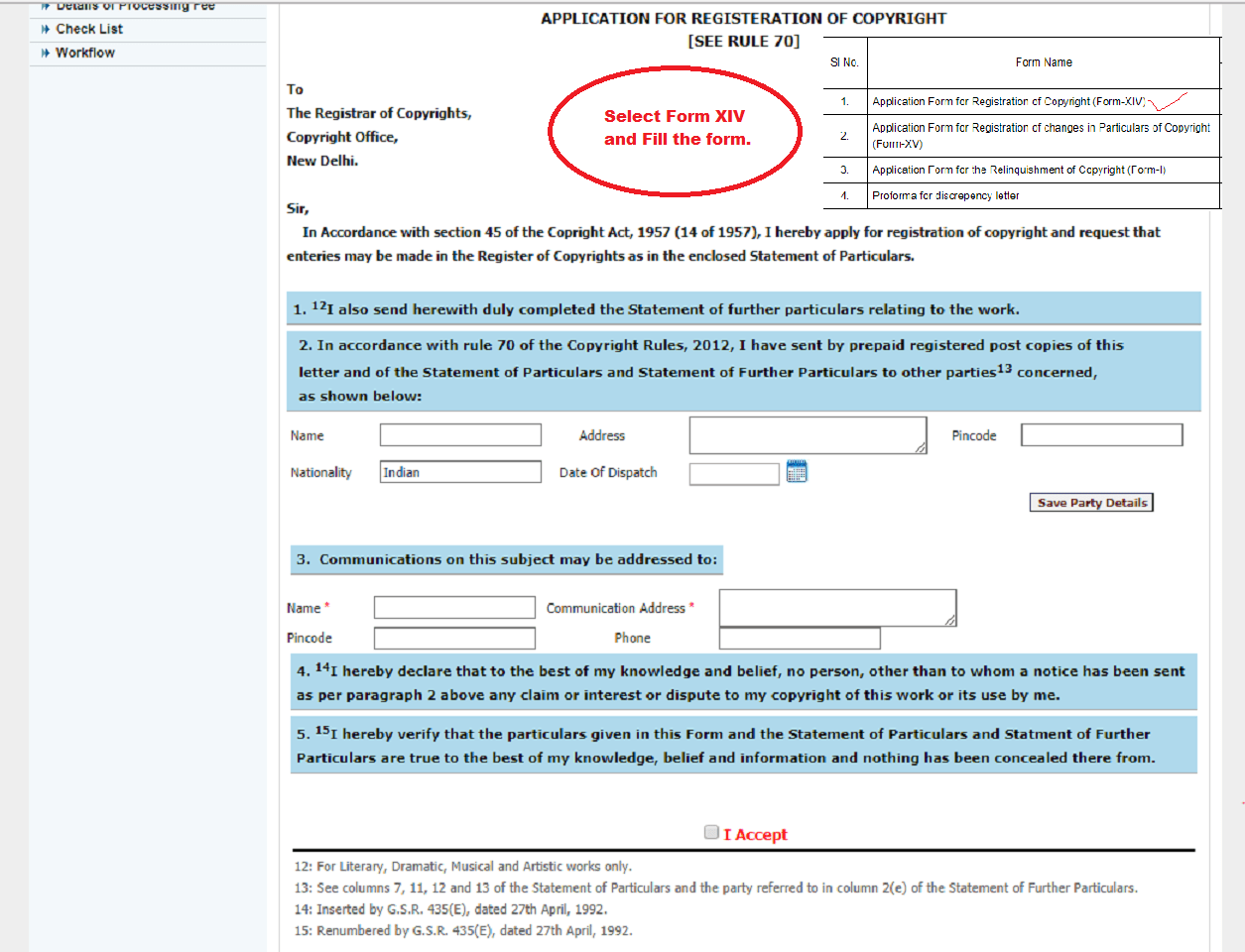

Procedure:

Visit copyright.gov.in

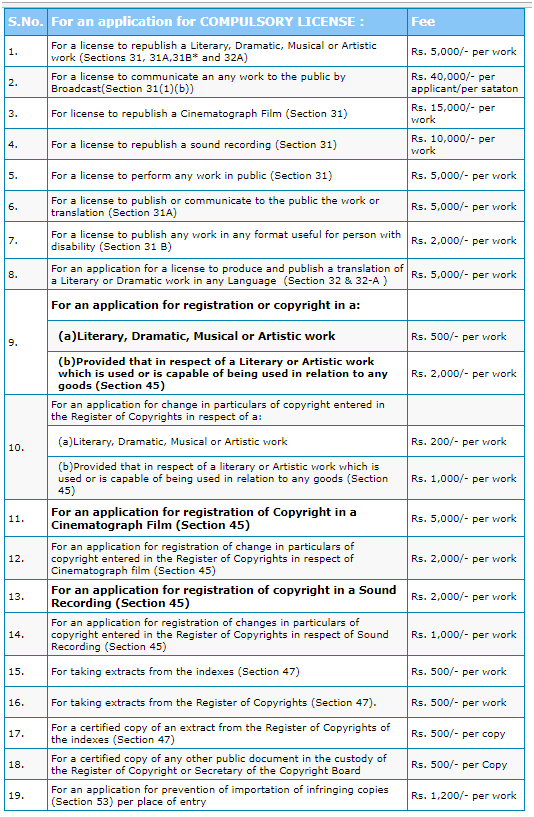

Pay the requisite fees.

- Every application has to be signed by the applicant as well as an Advocate in whose favor a Vakalatnama or a POA has been executed

- The registrar will issue a Dairy No. and then there is a mandatory waiting time for a period of 30 days for any objections to be received

- If there are no objections received within 30 days, the scrutinizer will check the application for any discrepancy and if no discrepancy is there, the registration will be done and an extract will be sent to the registrar for the entry in the Register of Copyright.

- If any objection is received, the examiner will send a letter to both the parties about the objections and will give them both a hearing.

- After the hearing, if the objections are resolved the scrutineer will scrutinize the application and approve or reject the application as the case may be.

For registration of copyright or for any queries regarding the same contact kiran@jain.software